New Immigrants Arriving to Long Island: Economic Projections

Immigration is not a new social trend on Long Island. Of the 2.9 million people living on Long Island, 585,000 are immigrants, 20 percent of the total population.

Over the past two years, however, a new trend in immigration has generated a different kind of attention. The number of people seeking asylum and other protection in the United States has risen sharply, with Long Island also seeing its share of newly arriving immigrants.

How can we expect these new immigrants to fare in the economy? To model this question, Immigration Research Initiative looked at how immigrants with similar characteristics currently make ends meet on Long Island.

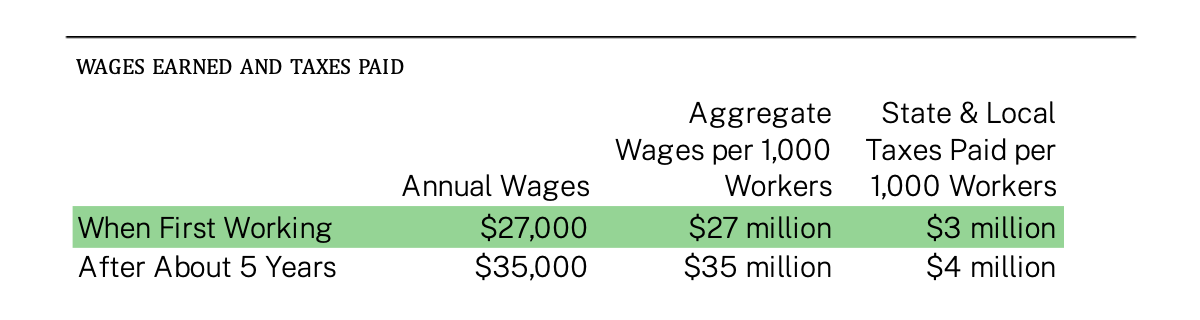

Wages Earned and Taxes Paid by Newly Arriving Immigrants

New immigrants arriving to Long Island can expect to earn a median wage of about $27,000 per year. If there are two wage earners in a family, as is likely the case for most of the immigrants coming to New York, their combined income would be about $54,000.

Fig. 1: Immigration Research Initiative modeling, using data from 2021 American Community Survey 5-year data. See methodology section for details.

That means newly arriving immigrants will have a hard time making ends meet in a region where cost of living is high, but they are likely to be above the federal poverty level even when they first get here. The federal poverty level in 2021 was $12,880 for individuals and $26,500 for a family of four.

Once immigrants have been here for about five years, their median wage will likely increase to about $35,000 per year, as they earn higher wages and as a larger share get full-time jobs, making a two-income family’s income about $70,000.

Newly arriving immigrants also grow the economy and pay taxes. In the first year after arrival, the IRI model predicts that for each 1,000 newly arrived immigrant workers the total annual wages paid is $27 million—a direct economic benefit to the region—and state and local tax revenues would increase by $3 million. After these immigrants have been here for about five years, the IRI model predicts that for each 1,000 workers annual wages to be $35 million and tax revenues would be $4 million.

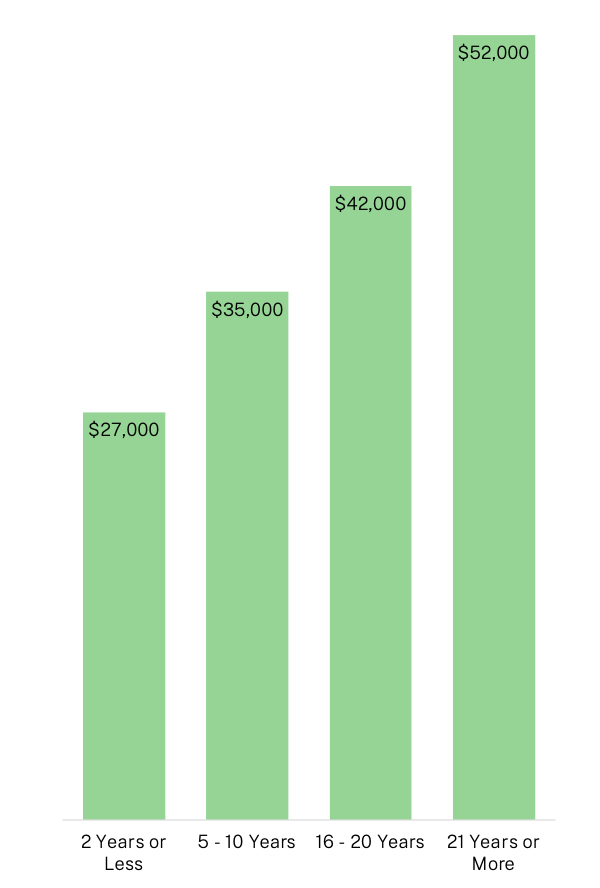

Immigrants Move Up in the Economy Over Time

The long history of immigration in the United States shows that once immigrants get a footing in the economy, they learn English, get better jobs, and earn higher wages. There is every reason to think that, given the opportunity, people currently seeking safety in this country would do the same.

By the time immigrants have been here about five years, they can expect to earn about $35,000, up from a $27,000 median wage for those who have been in the U.S. less than two years. A key reason for this is that many immigrants start working part-time jobs when they first get to the U.S., and then get full-time jobs once they have settled. After being here for about 15 years the projected median wage is $42,000, and after about 20 years it is $52,000. In many cases, families have two working adults, which makes their family income double the individual wage.

Projection of Wage Advancement for Newly Arriving Immigrants

Fig. 2. Immigration Research Initiative analysis of 2021 ACS 5-year data. Projected wages are in 2021 dollars.

Projected wages are in 2021 dollars, so the future wages can be understood in today’s economic terms. This also assumes some pathway to work authorization, for those who do not gain work authorization the upward path is limited.

For reference, double the federal poverty level is about $26,000 for individuals, and $53,000 for a family of four.

When immigrants first arrive to Long Island, the IRI model shows some of the positions immigrants are most likely to find are as childcare workers, waiters, cashiers, janitors, hand laborers and movers, maids and housekeepers, construction laborers workers, and personal care aides.

By the time immigrants have been here for longer and learn English better, many continue in these positions, but some also work as teaching assistants, licensed practical nurses, and in computer occupations.

Methodology

To model the likely outcomes for new arrivals, IRI looked at immigrants on Long Island New York who had been in the country for less than two years, and who don’t speak English very well.

To model the outcome for those who have been here for about five years, we expanded the analysis to include those who speak English “very well,” but did not include those who speak “only English” at home, reflecting the fact that most—though not all—immigrants learn to speak the language very well within five years. We did not include in the analysis people who speak “only English at home. To get a robust sample size, IRI looked at two years for new arrivals and five to ten years for those who have been here longer.

The tax analysis is based a simple use of the Institute on Taxation and Economic Policy’s report “Who Pays: A Distributional Analysis of the Tax Systems in All 50 States.” According to the most recent, 6th Edition, all New Yorkers pay between 11 and 13 percent of their income in taxes. Families with $17,000 would pay 11.4 percent of that in taxes, those with $30,000 would pay 11.3 percent, those with $60,000 would pay 12.4 percent. The range is not large, but to be conservative, IRI used the lowest of all of these, 11.3 percent.

Many, but not all, of the workers would have work authorization. Many newly arriving immigrants are eligible to apply for Temporary Protected Status, humanitarian parole, asylum, or other designations that give them temporary or permanent work permits. The Institute on Taxation and Economic Policy’s related report, “Undocumented Immigrants’ State and Local Tax Contributions,” shows that immigrants without work authorization pay an effective tax rate of 8.9 percent, a little lower than those with work authorization. The overall tax estimate might be increased some by families with incomes on the higher range, and decreased some by the proportion of immigrants who are undocumented.