New Yorkers Who Are Undocumented: Occupations, Taxes Paid, and Long-Term Economic Benefits

New York State is home to over 4 million immigrants, among them an estimated 640,000 immigrants who are undocumented, according to the most recent estimates by the Center for Migration Studies, from 2019.1Estimate of the number of immigrants who are undocumented and their characteristics are Immigration Research Initiative’s tabulation of data from the Center for Migration Studies (CMS). http://data.cmsny.org/ The CMS data is the most recent available based on the American Community Survey of 2019. More recent migrants are not included in this analysis, and are considered later in the paper. This is the pre-covid number of people who were undocumented in New York, many of whom had been here for years. More recent arrivals will also be discussed below.

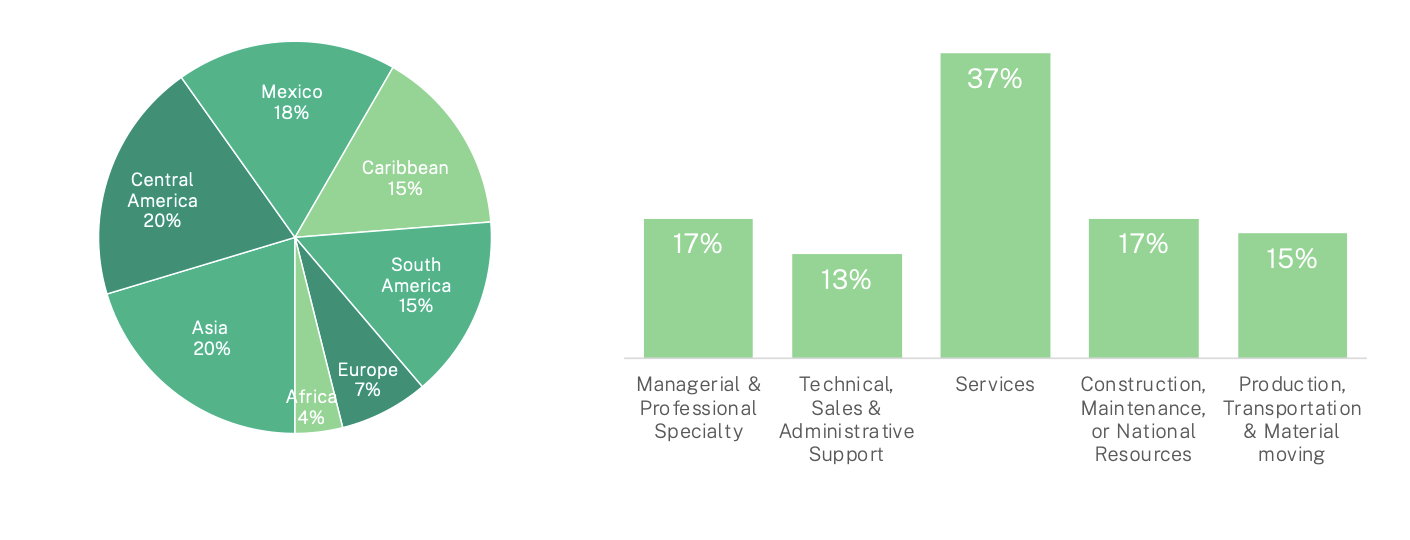

Immigration in New York is extraordinarily diverse, and this is true of people who are undocumented as well. The majority come from Latin America—Mexico, Central America, South America, and a portion of the Caribbean. In addition, 20 percent come from Asia, 7 percent from Eastern or Western Europe, and 4 percent from Africa. Top individual countries of birth, after Mexico, are China, El Salvador, the Dominican Republic, Guatemala, Ecuador, Honduras, India, and Jamaica, all between 4 and 8 percent of the total.

People who are undocumented are severely limited in their ability to move upward in the economy, so they are typically working in low-wage jobs. Yet, they work in a wide range of low-wage jobs, from retail shops to restaurants, construction, housekeeping, building services, and more. Thirty-seven percent work in services, 17 percent in the sector that includes construction, and 18 percent in some kind of management position (and a few in professional specialty jobs).

It has for many years been nearly impossible for the vast majority of people who are undocumented to normalize their papers in the United States. And, most New York residents who are undocumented (55 percent) have been in this country for ten years or more.

Where Immigrants Who Are Undocumented Come From, And Where They Work

Figure 1: Immigration Research Initiative tabulation of data from the Center for Migration Studies estimates based on 2019 ACS data.

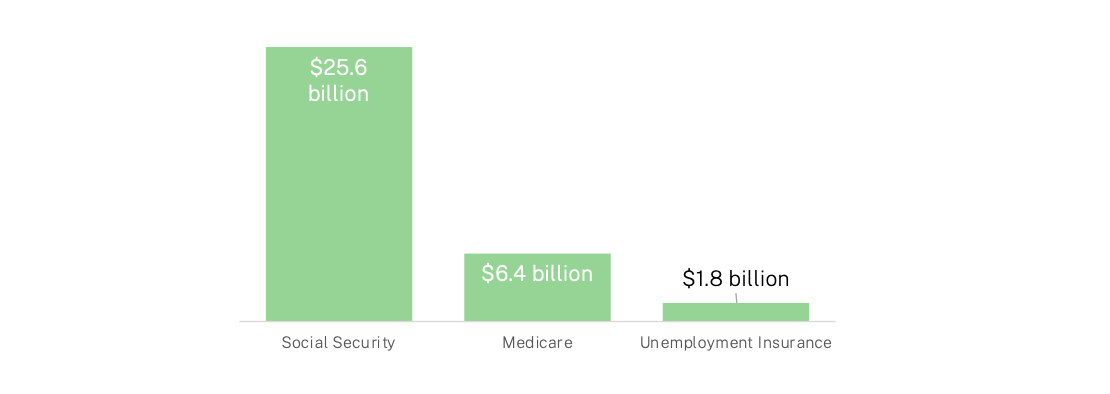

Immigrants Who Are Undocumented Pay $59 Billion in Federal Taxes & $34 Billion to Social Insurance Programs That Exclude Them From Benefits

Figure 2. Immigration Research Initiative tabulation of data from Institute on Taxation and Economic Policy. People who are undocumented have wages withheld to pay for these programs, yet they are excluded from the benefits other workers get.

Even People Who Are Undocumented Pay Taxes

Despite widespread misunderstanding about the fact, people who are undocumented also pay local, state, and federal taxes.

As a July 2024 report from the nonpartisan Institute on Taxation and Economic Policy shows, people who are undocumented paid $59 billion in federal taxes in 2022. A total of $34 billion comes from payroll taxes to cover programs that exclude people who are undocumented from getting benefits: $25.6 billion paid to Social Security, $6.4 billion to Medicare, and, through contributions of their employers, $1.8 billion to unemployment insurance (which is a joint federal and state program). In other words, workers who are undocumented have wages withheld or employers are required to pay for programs that benefit other Americans, but which systematically leave them behind.2“Taxes Paid by Undocumented Immigrants,” Carl Davis, Marco Guzman, and Emma Sifre, Institute on Taxation and Economic Policy, July 2024. This analysis uses a slightly different estimate of the number of people who are undocumented in New York State, 676,000, than the estimate from the Center for Migration Studies above. One notable exception: Colorado recently passed a Benefit Recovery Fund that allows workers who are undocumented to receive a form of unemployment compensation if they would otherwise qualify for regular unemployment benefits. The Colorado Benefit Recovery Fund is described here: https://ona.colorado.gov/press-release/media-advisory-benefit-recovery-fund-applications-now-open.

New York State residents who are undocumented currently pay $3.1 billion in state and local taxes. This includes $920 million in sales tax, $1 billion in property tax, and $1.2 billion in personal and business income taxes. People who are undocumented pay an effective tax rate (total taxes paid divided by total income) of 10.6 percent in New York State. By comparison, other New York tax filers pay between 11.1 and 13.8 percent, a little but not a lot higher.3For effective tax rates of New Yorkers, see “Who Pays, 7th Edition,” Institute on Taxation and Economic Policy, January 2024, Appendix A. https://sfo2.digitaloceanspaces.com/itep/ITEP-Who-Pays-7th-edition.pdf In New York, people who are undocumented, and anyone filing a tax return using an Individual Taxpayer Identification Numbers (ITIN), is excluded from getting the state’s Earned Income Tax Credit. By contrast, ten states, plus Washington, DC, allow people using ITINs to claim this tax credit that they have earned.4The overwhelming majority of people filing taxes using ITINs are people who are undocumented, but there are some limited reasons others may also file this way. The National Immigration Law Center has mapped the areas where people filing taxes with ITINs can claim the Earned Income Tax Credit: https://www.nilc.org/issues/taxes/tax-credit-itin-filers/

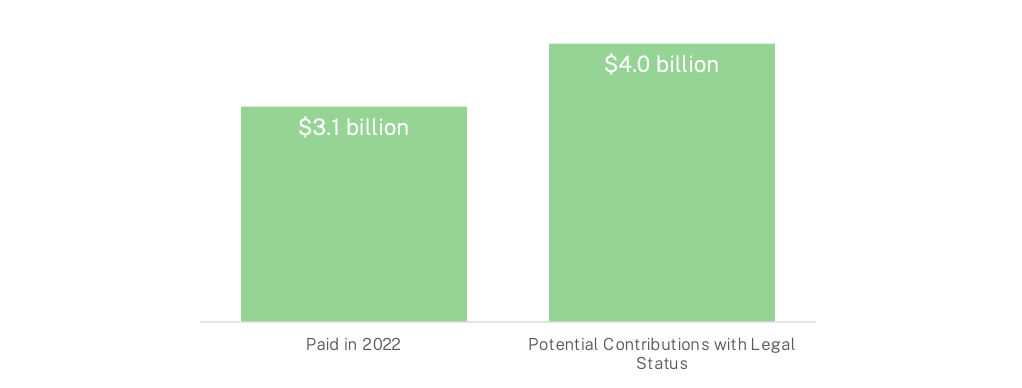

New York State and Local Taxes Paid by People Who Are Undocumented

Figure 3. Immigration Research Initiative tabulation of data from Institute on Taxation and Economic Policy.

If people who are undocumented were allowed a pathway to citizenship, through federal legislation, there would be a gain to the economy, to individual workers, and also to the state tax coffers. With legal status, immigrants who are currently undocumented would advance in their jobs, and a higher proportion would also file income tax returns. The gains to New York’s state and local governments would be substantial: instead of $3.1 billion, the total revenues would be $4.0 billion, a gain of nearly $900 million.5The exact amounts are: $3,102,700,000 in current contributions, $3,953,600,000 for potential contributions with legal status, and a difference of $850,800,000. This is rounded to $3.1 billion, $4.0 billion, and a difference of $900 million.

Asylum Seekers and New Immigrants Expand the Economy in the Long Run

In the past two years, there has been a sudden and unexpected increase in the number of immigrants arriving in New York State. Some have been sent on busses from Texas with the explicit intention of provoking a crisis in New York, and others have come on their own. New York City government reports that over 200,000 have come through the city’s system since the spring of 2022, and 66,000 are currently in city-funded shelter.6“Accounting for Asylum Seeker Services,” Asylum Seeker Census, on the web page of the New York City Comptroller. https://comptroller.nyc.gov/services/for-the-public/accounting-for-asylum-seeker-services/asylum-seeker-census/. Accessed July 25, 2024. The page is broadly titled asylum seekers, but the data includes all new arrivals in the system and does not attempt to rigorously determine who may apply or already has applied for asylum. Some of the immigrants who came through the New York City reception system—as well as some others—have moved into other parts of downstate New York, and into some areas of Upstate.

These new arrivals include people who are seeking asylum, as well as people who may be eligible for temporary protected status (TPS) or other forms of official status—and as a result will likely eventually get at least temporary work authorization. Others are undocumented and will likely be in a similar position as the 640,000 other immigrants who are undocumented.

At the federal level, the Congressional Budget Office (CBO) reported in July 2024 that the unexpected increase in the number of immigrants to the U.S. can over the long run be expected have an overall positive economic and budget impact. The CBO shows an increase to the overall GDP of the United States of $8.9 trillion over the 10-year period it considers, 2024 to 2034. At the end of the 10-year period, that represents a 3.2 percent increase in GDP compared to what it would be without these added immigrants.

The impact on the federal budget is positive as well. Overall, assuming that the current surge in immigration continues, the surge in immigration is expected to decrease the federal deficit by $900 billion over the 10-year period. That is due to an expected increase of $1.2 trillion in federal revenues, and an increase of $0.3 billion in added federal expenses.

In New York State, there are significant short-term expenses and challenges in getting new immigrant arrivals settled, most significantly around short-term shelter and finding long-term housing, but also in legal services and education of children for example.

In the long run, however, the state clearly benefits from a growing population and labor force. A series of reports by Immigration Research Initiative in early 2024 modeled the long-term economic outcomes for new immigrants in different regions of the state. Statewide, immigrants were found to likely increase wages from a median of $22,000 in the first 2 years to $30,000 from 5-10 years and $42,000 for more than 21 years. State and local taxes paid were seen to increase from $2 million per 1,000 added workers to $3 million per 1,000 workers.7New York State data is available in figure 3 of Economic Projections for Asylum Seekers and New Immigrants: U.S. and State-Level Data. https://immresearch.org/publications/economic-projections-for-asylum-seekers-and-new-immigrants-u-s-and-50-states/ And, regional projections are available at https://immresearch.org/publications/new-immigrants-arriving-in-the-lower-new-york-state-regional-economic-projections/.

- 1Estimate of the number of immigrants who are undocumented and their characteristics are Immigration Research Initiative’s tabulation of data from the Center for Migration Studies (CMS). http://data.cmsny.org/ The CMS data is the most recent available based on the American Community Survey of 2019. More recent migrants are not included in this analysis, and are considered later in the paper.

- 2“Taxes Paid by Undocumented Immigrants,” Carl Davis, Marco Guzman, and Emma Sifre, Institute on Taxation and Economic Policy, July 2024. This analysis uses a slightly different estimate of the number of people who are undocumented in New York State, 676,000, than the estimate from the Center for Migration Studies above. One notable exception: Colorado recently passed a Benefit Recovery Fund that allows workers who are undocumented to receive a form of unemployment compensation if they would otherwise qualify for regular unemployment benefits. The Colorado Benefit Recovery Fund is described here: https://ona.colorado.gov/press-release/media-advisory-benefit-recovery-fund-applications-now-open.

- 3For effective tax rates of New Yorkers, see “Who Pays, 7th Edition,” Institute on Taxation and Economic Policy, January 2024, Appendix A. https://sfo2.digitaloceanspaces.com/itep/ITEP-Who-Pays-7th-edition.pdf

- 4The overwhelming majority of people filing taxes using ITINs are people who are undocumented, but there are some limited reasons others may also file this way. The National Immigration Law Center has mapped the areas where people filing taxes with ITINs can claim the Earned Income Tax Credit: https://www.nilc.org/issues/taxes/tax-credit-itin-filers/

- 5The exact amounts are: $3,102,700,000 in current contributions, $3,953,600,000 for potential contributions with legal status, and a difference of $850,800,000. This is rounded to $3.1 billion, $4.0 billion, and a difference of $900 million.

- 6“Accounting for Asylum Seeker Services,” Asylum Seeker Census, on the web page of the New York City Comptroller. https://comptroller.nyc.gov/services/for-the-public/accounting-for-asylum-seeker-services/asylum-seeker-census/. Accessed July 25, 2024. The page is broadly titled asylum seekers, but the data includes all new arrivals in the system and does not attempt to rigorously determine who may apply or already has applied for asylum.

- 7New York State data is available in figure 3 of Economic Projections for Asylum Seekers and New Immigrants: U.S. and State-Level Data. https://immresearch.org/publications/economic-projections-for-asylum-seekers-and-new-immigrants-u-s-and-50-states/ And, regional projections are available at https://immresearch.org/publications/new-immigrants-arriving-in-the-lower-new-york-state-regional-economic-projections/.